The Banking AI Agent Platform behind the most capable AI agents

interface.ai’s purpose-built Banking Agents OS platform makes it effortless to create, deploy, and manage highly capable AI agents.

100+

Trusted by 100+

credit unions & banks

14M+

14 million+ people

served

served

1.5M+

1.5 million+

conversations everyday

conversations everyday

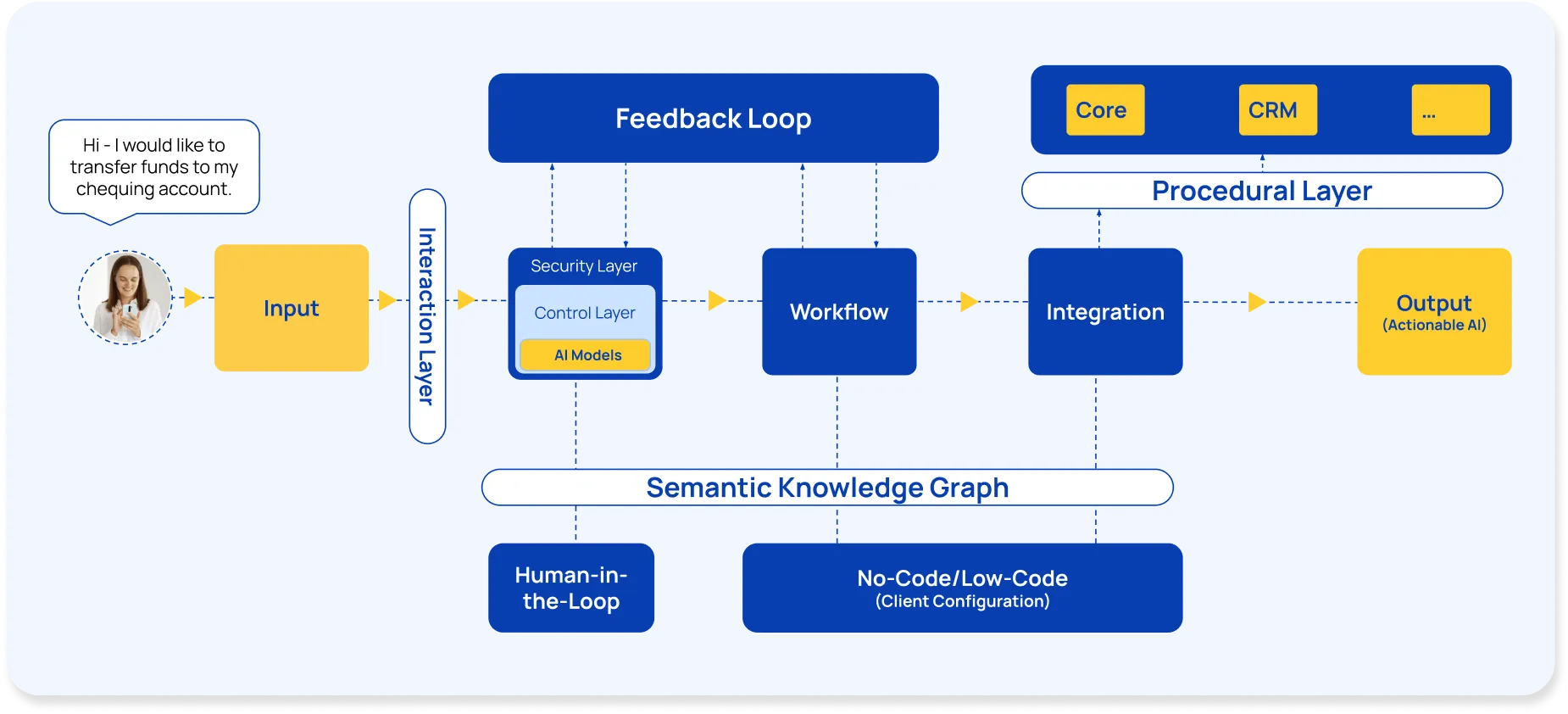

Combine the power of multiple LLMs with rule-based workflows

interface.ai’s AI Agent platform combines the power of the best LLM foundation models with rule-based workflows to ensure precise, compliant processing of all requested transactions during conversations. Every transaction is fully auditable, guaranteeing 100% transparency and accountability.

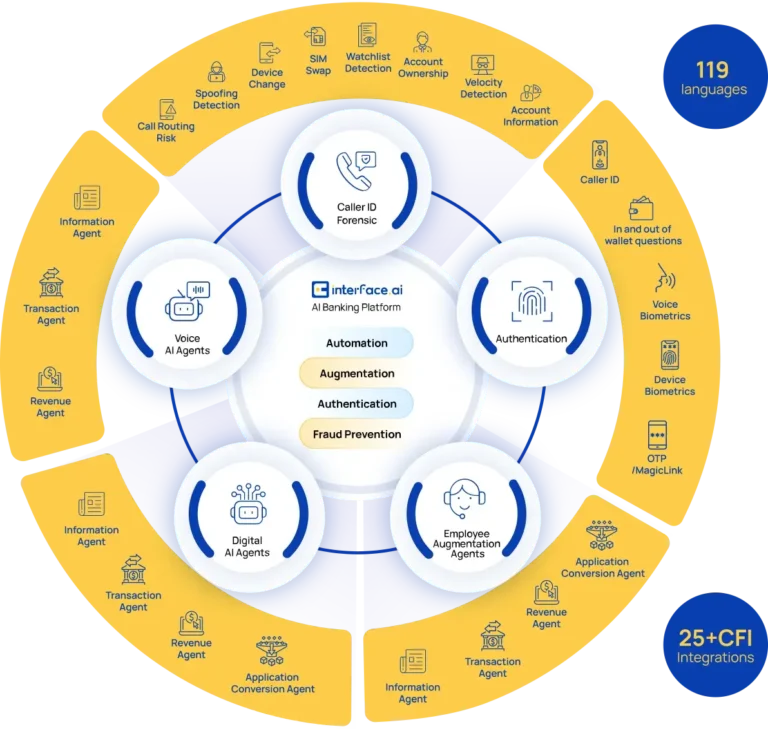

Tailored functionality for banking-specific needs

Our AI Agent platform empowers you to tailor each agent to your specific needs. With a flexible rules engine, support for JavaScript, and custom outputs, you can define transfer limits, account types, and other unique requirements, ensuring compliant transactions.

Secure and scalable banking integrations

Our integration manager connects securely to 25+ core banking systems including features such as multi-factor authentication, access control, and data masking. New systems can be easily integrated by adding new modules.

Minimize hallucinations and training needs

With over 10 years’ real-world experience in financial services, interface.ai’s semantic knowledge graph is the most robust and accurate in the industry. The result? Reduced hallucinations, streamlined training, and reliable AI performance tailored for banking.

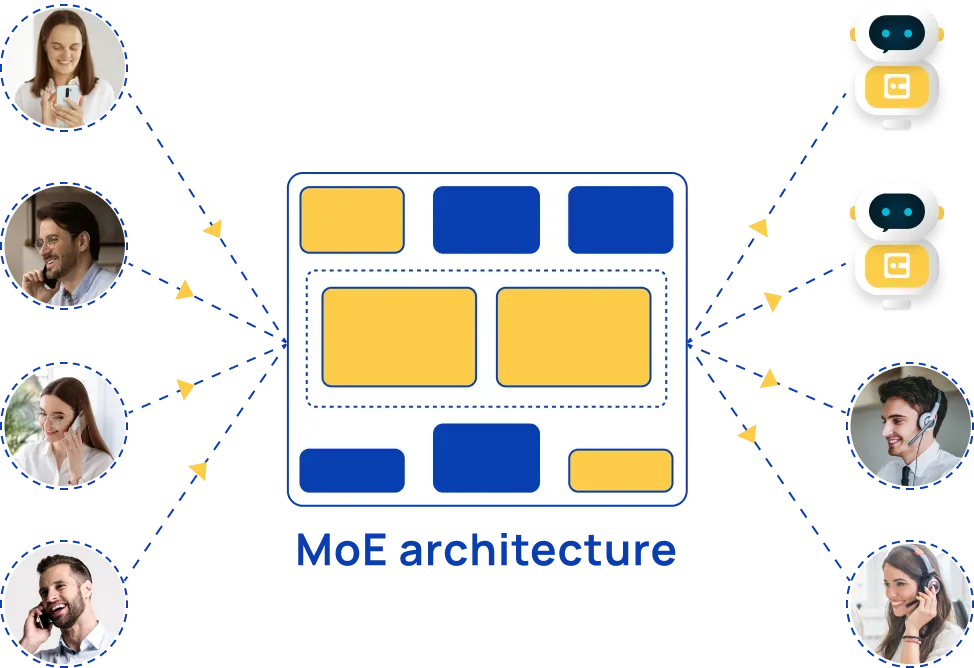

Enhanced accuracy and performance

To manage the vast range of queries that credit unions and banks face, interface.ai uses Mixture of Experts (MoE) architecture. This combines specialized models to ensure each interaction is managed by the appropriate expert, increasing accuracy, quality, and reliability.

ASR tuned to credit union and community bank needs

On top of industry-leading Automatic Speech Recognition (ASR), interface.ai’s proprietary tools allow customization for specific industry, institution, and even individual member needs. This uniquely tailored approach enhances the user experience while ensuring strict industry compliance.

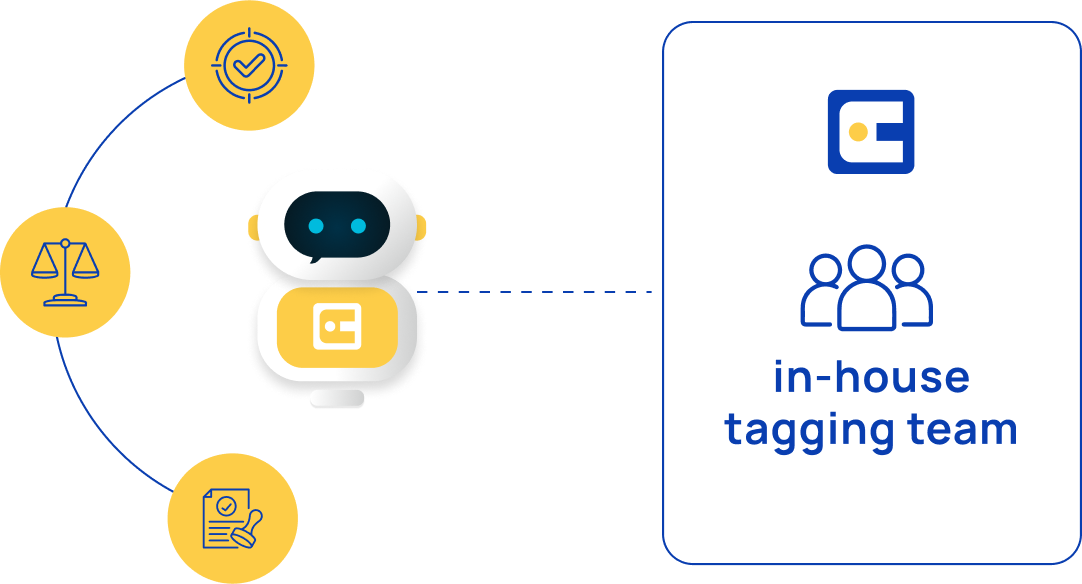

Human-in-the-Loop in-house tagging team

To improve input accuracy output compliance, interface.ai has an in-house team to provide real time tagging. This investment into an in-house tagging team ensures the highest level of accuracy and compliance for our Banking AI Agent platform.

Continuous improvement with intelligent feedback loops

interface.ai’s AI Agent platform auto-analyzes each request to detect parsing and workflow issues, and provide targeted suggestions for training and human review. LLMs are then re-trained, regression-tested, and updated. Workflow & integration improvements follow the same process, ensuring consistent optimization.

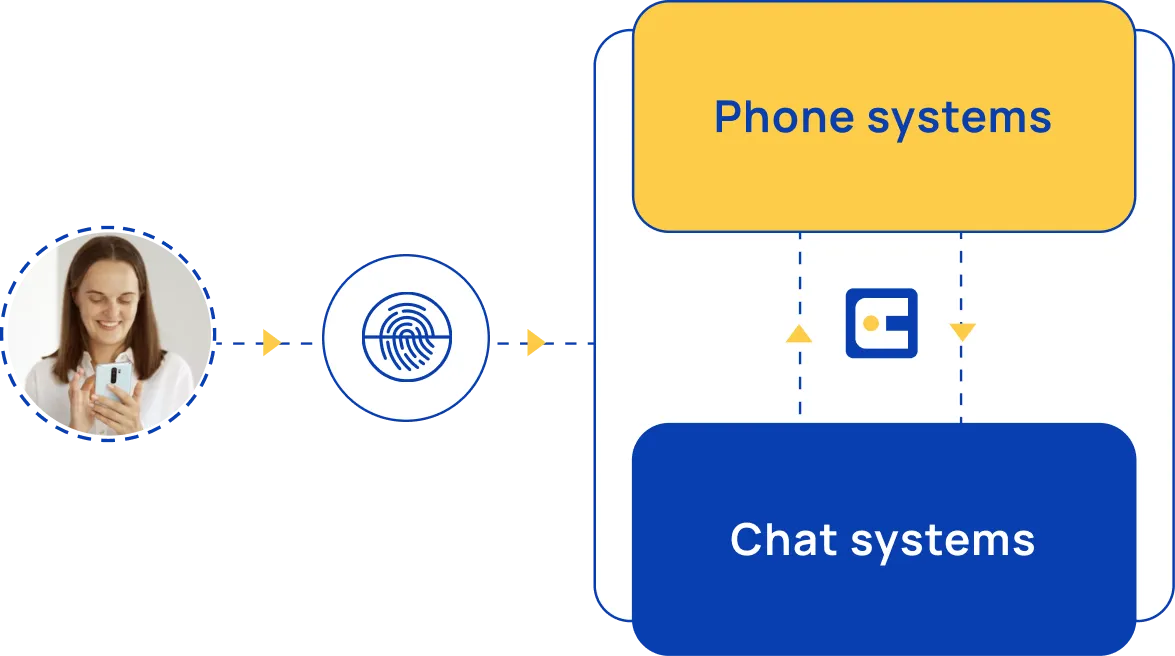

Transfer with context to phone & chat systems

In every support-facing role, some queries need the human touch. interface.ai’s platform integrates with leading phone and chat systems, seamlessly transferring conversations with transcripts and authentication status for a frictionless member experience.

Data privacy and governance you can trust

Your data is yours, and interface.ai ensures it stays that way. Your data is securely isolated in a private workspace with strict separation between customers. Sensitive information like PII is automatically masked, and real-time integrations only access data when needed.

The interface.ai difference - What sets us apart

Unlike many platforms that simply layer APIs and workflow engines, interface.ai offers a robust, proprietary banking AI Agent platform built with over a decade of R&D. Field-tested and scale-tested, it’s uniquely designed for credit unions and community banks.

When comparing AI Agent platforms, look under the hood – none can match the capability and reliability of interface.ai.

Better experiences start with better answers.

Curious about what separates bad bots from good ones?