Traditional AI vs Generative AI: Which Best Serves Financial Institutions Today?

It’s no easy feat keeping up with the development of AI – but it’s essential. The adoption of AI is predicted to add $170bn to banks’ profits in the next five years, according to a report by Citi.

When AI first began making waves in customer service in the early 2000s, traditional AI solutions offered the groundbreaking ability to automate basic, repetitive tasks, providing institutions with efficiencies previously unimaginable. Since then, Generative AI has emerged to transform this landscape. It moves beyond simple automation to bring dynamic responses to every interaction. This shift is more than just a technical upgrade; it’s a leap forward, enabling institutions to interpret and respond to customers’ needs with remarkable depth and personalization.

As banks and credit unions look to redefine their approach to customer service in this new era, understanding the distinct capabilities of Generative AI vs traditional AI is essential. Here’s a breakdown of what sets these two approaches apart and why it matters.

What is traditional AI vs Generative AI?

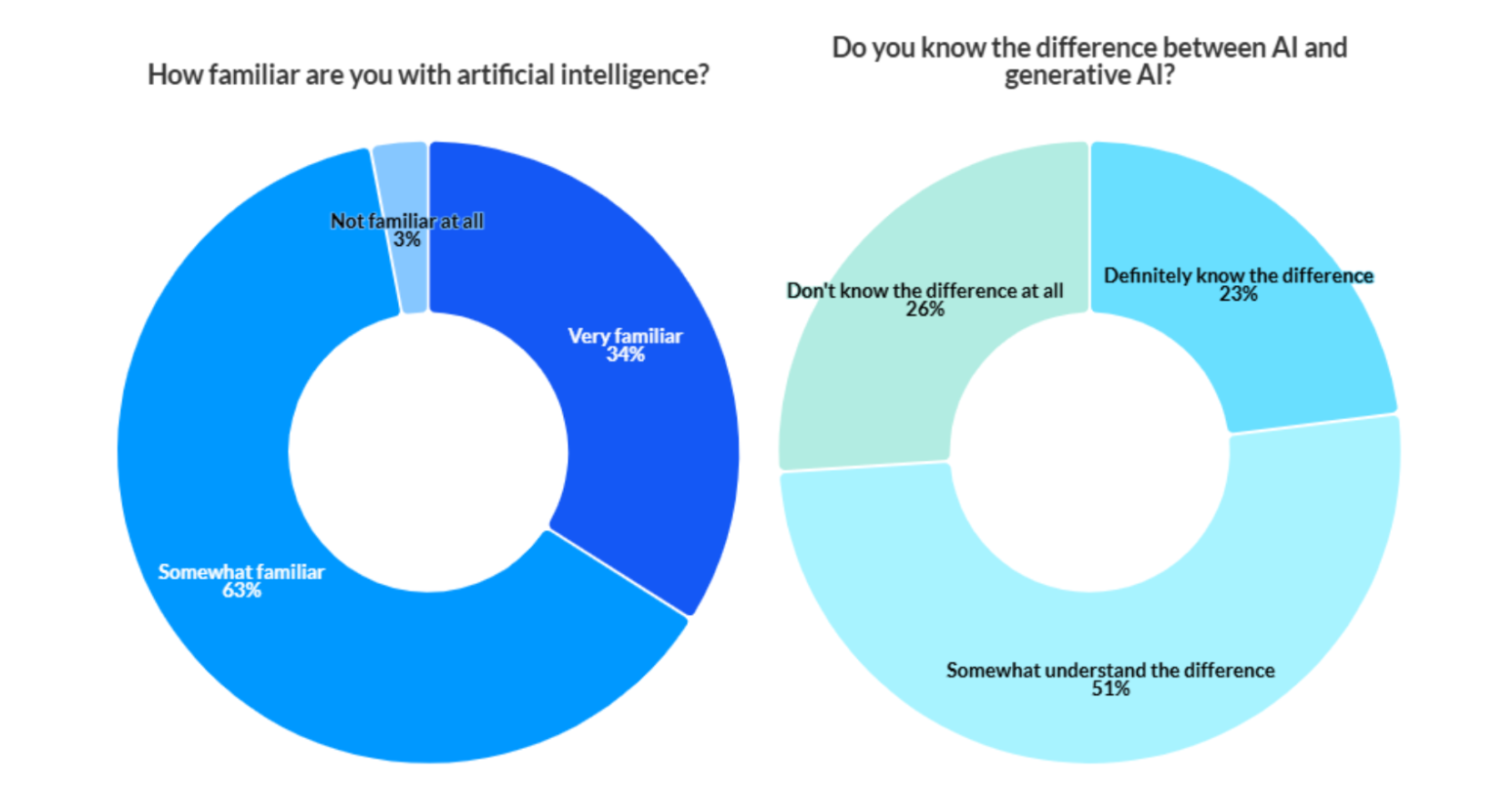

When financial institutions were surveyed on their knowledge of traditional ai vs Generative AI, the results were startling. Arizent, the publisher of American Banker, found that only 23% of respondents knew the difference between traditional and Generative AI, while 51% only understood the difference somewhat.

Traditional AI: Traditional AI operates on rule-based algorithms. It’s designed to recognize specific keywords or patterns and respond with pre-programmed answers. Think of it as a “question-answer match” system: if a customer’s question fits one of its preset scenarios, it delivers the corresponding answer. This approach works well for straightforward, repetitive tasks but can be limited by the specific responses and scenarios it has been programmed to handle.

Generative AI: Generative AI uses large language models (LLMs) trained on vast amounts of data which allows it to understand language patterns and generate responses based on the context of the conversation. Instead of matching a question to a predefined answer, Generative AI interprets the meaning behind the question and creates a dynamic response in real-time. This type of AI is flexible and can handle diverse and varied language, adapting its answers based on the flow of the conversation and its context.

Traditional AI vs Generative AI – The Key Differences and Why it Matters

- Handling complexity

Traditional AI: Traditional AI systems operate on predefined rules and keyword matching, mapping specific questions to set answers. This rule-based approach works well in narrow, predictable scenarios, providing consistent responses to routine questions. However, its rigid structure limits its capabilities – it can struggle to interpret or respond to complex, nuanced, or unfamiliar queries that fall outside its programmed scenarios.

Generative AI: Generative AI goes beyond keyword matching. By leveraging large language models (LLMs), it uses a deep understanding of language patterns to respond conversationally and adjust based on the flow of each interaction. Generative AI recognizes varied phrasing and even spelling differences, making it more adaptable and context-aware. This flexibility allows it to answer a broader array of questions with more accuracy and a natural, conversational style.

interface.ai’s hybrid approach: interface.ai brings together the best of both traditional and Generative AI. Its Generative AI handles complex, adaptive conversations to deliver a wide range of personalized and dynamic responses. In collaboration with this, interface.ai integrates the structured workflows of traditional AI to ensure reliable, rule-based support when specific steps or processes need to be followed. This hybrid approach provides both the adaptability of Generative AI and the control of traditional AI.

- Personalization

Traditional AI: Traditional AI can offer some level of personalization, depending on integrations. For instance, it may adjust responses to include a customer’s name or deliver responses based on broad categories like customer type (e.g., new versus long-time customers). However, its rule-based design limits its ability to adapt in real-time to individual preferences, detailed histories, or the conversational context of each interaction.

Generative AI: Generative AI, by contrast, enables highly personalized customer interactions by analyzing conversation context, customer data, and knowledge graphs. It adapts responses based on each customer’s needs, preferences, and history, creating individualized interactions. This personalization builds trust, enhances customer experience, and can even support revenue growth through relevant and timely cross-sell and upsell opportunities.

- Bot training

Traditional AI: Training a traditional AI bot is highly time-consuming and resource-intensive. Even with a wealth of company resources, every question and response must be manually scripted. This typically stretches the setup timeline to several months.

Generative AI: Generative AI drastically reduces training time by learning directly from existing company resources, such as website content, documents, and multimedia. Rather than manually scripting responses, the AI instantly processes and adapts to this information, enabling a fully capable AI bot to be deployed in days rather than months.

interface.ai is the only AI financial services provider to offer this Generative AI capability. Learn more here.

- Bot management and improvement

Traditional AI: Traditional AI requires frequent manual updates to remain accurate and relevant. When policies or offerings change, human intervention is needed to reprogram responses. This leads to increased costs and the potential for outdated and inaccurate information.

Generative AI: In contrast, Generative AI autonomously scans for updates, instantly adapting its responses to reflect any changes in content. This approach eliminates the need for manual reprogramming, reducing both time and costs while ensuring accuracy. Additionally, Generative AI like that of interface.ai’s, learns from every interaction so it continually becomes more intelligent and can align more closely with the institution’s standards and goals.

Wrap-up

The capabilities of AI are transforming the banking experience. On the one hand, traditional AI laid the foundation for effective automation. Now, Generative AI’s ability to handle complex queries, personalize interactions, and self-improve through continuous learning is setting a new standard for intelligent, adaptable service.

With interface.ai’s hybrid approach, institutions can harness the strengths of both AI types – offering responsive, personalized support while maintaining consistency and control with key workflows. This evolution in AI technology is redefining how banks and credit unions engage with their customers, paving the way for a more dynamic, customer-centered approach to service.

To find out more about interface.ai’s pioneering AI solutions, book a demo with our expert team.

Discover the Latest Insights on Interactive Intelligence for Banking Newsletter

Join the newsletter to receive the latest updates in your inbox.